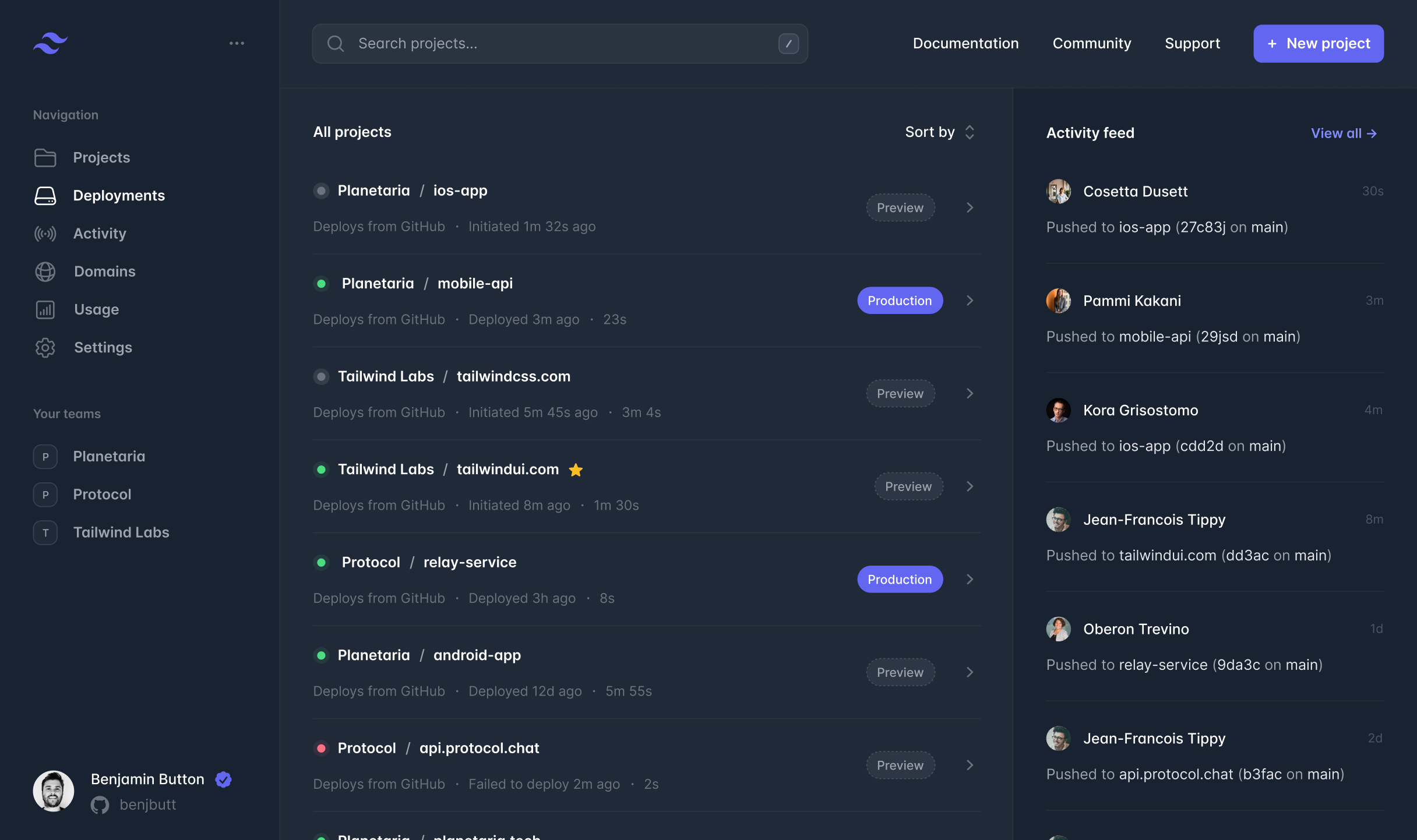

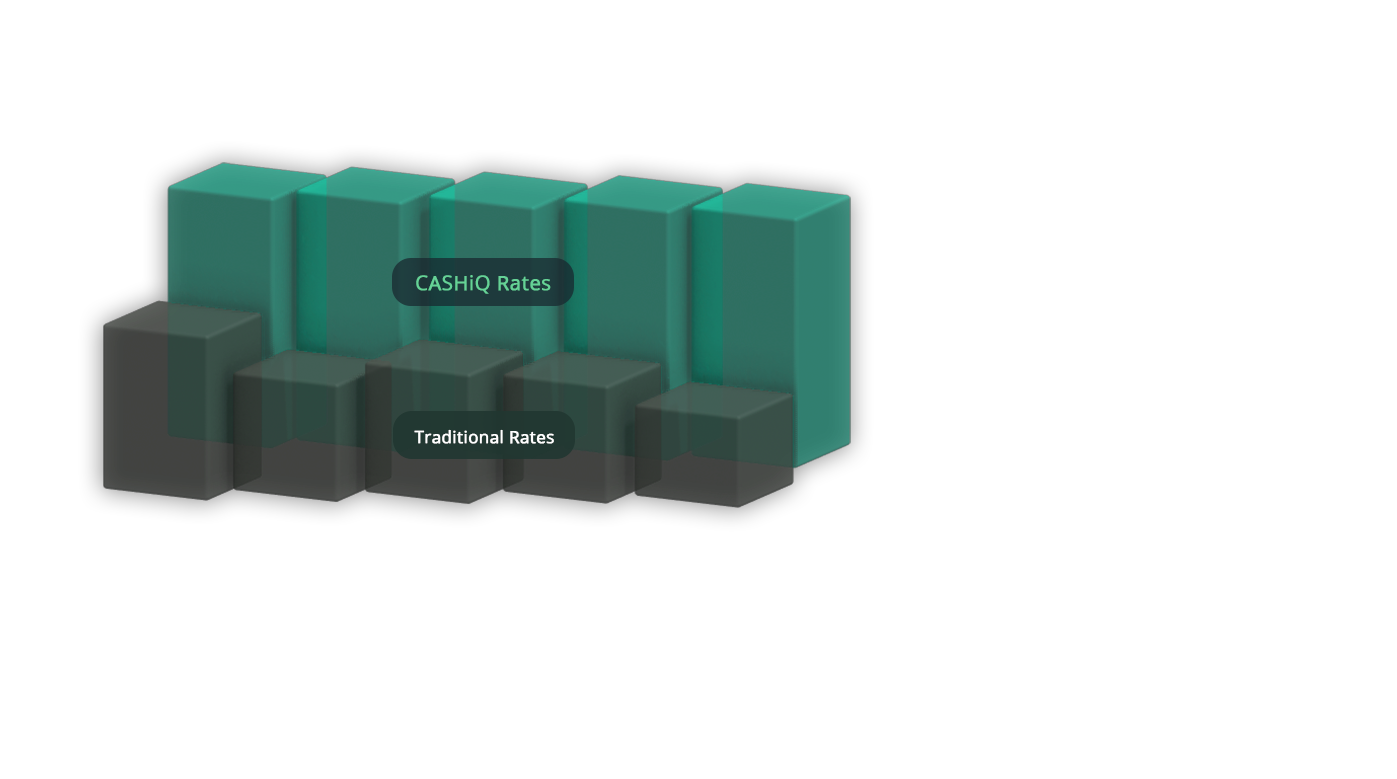

GICs can offer higher yields than traditional cash equivalent products – chequing and savings accounts as well as bonds and money market alternatives. You can earn more than equivalent GIC terms with any of the big 5 Canadian banks. CASHiQ is connected to many of the GIC premium rates offered by Financial Institutions across Canada and you can create a customized portfolio of GICs based on your personal preferences and time horizons while optimizing yield.

CASHiQ offers the best GIC rates from many of the insured financial institutions across Canada. You have full flexibility to build your GIC portfolio of your choice within our extensive roster of Financial Institutions.

Most GICs are non-Cashable thereby locking your money into a term deposit investment from 1 to 5 years. This allows the financial institutions to pay you a better rate than most high interest savings accounts. There are Cashable GICs that offer attractive rates however they are slightly less than the non-Cashable rates.

CASHiQ provides you with the digital tools to construct an insured portfolio of GICs that meets your cash surplus or future cash needs so that you maximize the interest earned on your cash.